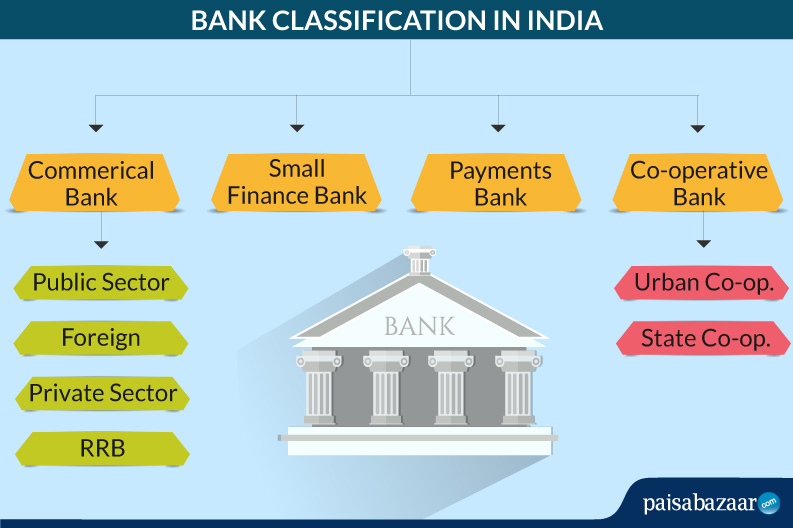

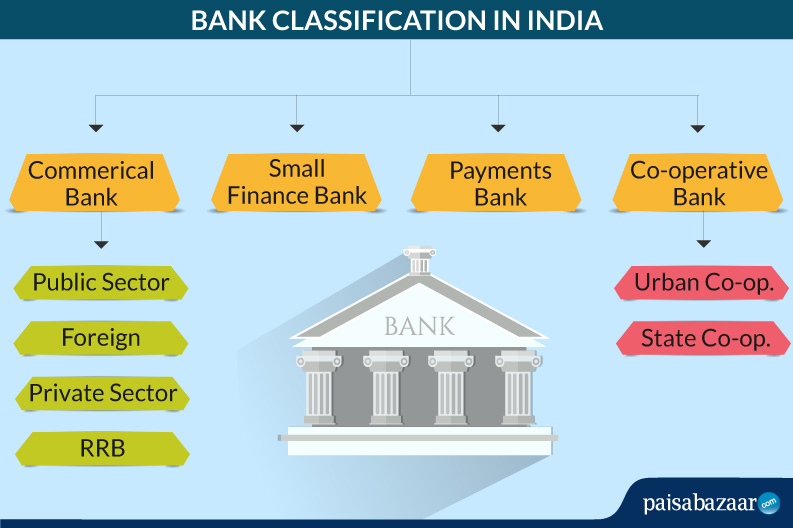

So understanding this topic is very important. Commercial banks are of three types ie Public sector banks Private sector banks and Foreign banks.

Banking In India Types Of Banks Banking Classification Paisabazaar

This topic is important for bank exams as generally many questions are asked in bank exams and interview on bank accounts like what are different types of accounts in the bank what is the difference between a current account and saving the account.

. Indian Bank and Dena Bank. Industrial banks provide long term and medium term finance to industrial units. These also provide technical and managerial guidance to industrial units.

Dena Bank and Vijaya Bank. For purposes of modernization expansion etc. Each country has a central bank that regulates all the other banks in that.

Depending on how long the assets have been an NPA there are different types of non-performing assets as well. Specialized Banks-There are some banks that cater to the requirements and provide overall support for setting up a business in specific areas. For example RBC Centuras merger with Eagle Bancshares Inc.

An example would be a credit card as there is a capped limit the credit card limit and you can keep using it until you reach such a limit then over-limit fees apply. Are examples of industrial banks. Primary- Industries which deal with obtaining or offering raw materials which are processed as commodities for the customers.

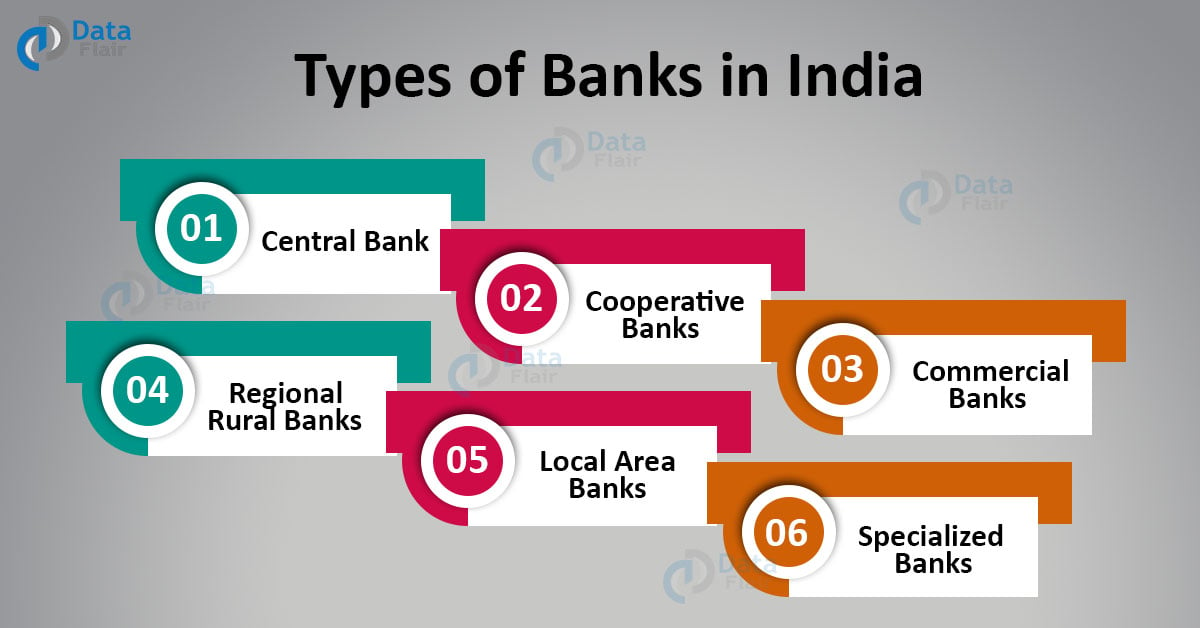

The Reserve Bank of India is the central bank of our country. Global investment banks include JPMorgan Chase Goldman Sachs Morgan Stanley Citigroup Bank of America Credit Suisse and Deutsche Bank. Secondary- Industries which are essentially manufacturing or assembling industries.

It is obviously not possible for one functional manager to manage efficiently such widely spread activities. What is an asset for a bank. This is treated as a stock acquisition by the.

They are given below. Their business mainly consists of receiving deposits giving loans and financing the trade of a country. Asset means anything that is owned.

The Allahabad Bank Bank of Baroda Bank of India Bank of Maharashtra Central Bank of India Canara Bank Dena Bank Indian Bank Indian Overseas Bank Punjab National Bank Syndicate Bank UCO Bank Union Bank of India United Bank of India were nationalized in 1969. These are banks where majority stake is held by the Government of India or Reserve Bank of India. This is their special feature.

For banks a loan is an asset because the interest we pay on these loans is one of the most significant sources of income for the bank. They provide short-term credit ie lend money for short periods. Types of Commercial Banks 1 Public sector banks Public sector banks are those banks in which the major holding is of the government.

These banks provide financial and advisory assistance to their customers. 2 Private sector banks Private sector banks are those banks that are owned. In 2002 was a market-extension merger that helped RBC with its growing operations in the North American market.

These banks play the most important role in modern economic organisation. Industrial Development Bank of India IDBI Industrial Credit and Investment Corporation of India ICICI etc. Co-operative banks operate in both urban and non-urban areas.

It receives raw materials from primary industries and processes them to. Types of Commercial Banks. Bonus Round Multiple Choice Questions.

Eagle Bancshares owned Tucker Federal Bank one of the biggest banks in Atlanta with over 250 workers and 11 billion in assets. Andhra Bank and UCO Bank. Types of Banks In Nigeria and Their Functions Explained.

7 Different types of mergers with examples. Examples of public sector banks are State Bank of India Corporation Bank Bank of Baroda and Dena Bank etc. Another example would be a HELOC Home Equity Line of Credit Home Equity Line of Credit HELOC A Home Equity Line of Credit HELOC is a line of credit given to a person using their house as collateral.

Jammu Kashmir Bank is an example of a non-scheduled commercial bank. EXIM Bank SIDBI and NABARD are examples of such banks. Examples of such banks include postal saving bank commercial banks and cooperatives banks.

For eg when ICICI Bank acquired Bank of Madura Bank of Madura which was the target merged with the acquirer ICICI Bank. In these banks the features of commercial and co-operative. The main objective of the savings bank is to encourage savings of the people especially in rural areas.

Various types of industries are. Now lets move to the types of banks in Nigeria. Regional Rural Banks-These banks were established in 1975 to enhance the banking facilities in rural areas.

For example a bank may charge a 391 interest rate on a 30-year fixed rate mortgage but offer an interest rate of only 015 on a savings account of 100000. In this case the buyer merges into the target and the shareholders of the buyer get stock in the target. The following are the types of banks in Nigeria namely.

SBI PNB OBC etc. Banks insurance companies transport companies distribution agencies etc are some examples of such enterprises where all the activities of a given area of operations are grouped into zones branches divisions etc. Want to know more about each of these types of banks right.

Regional Rural Banks RRB Local Area Banks LAB. Vijaya Bank and Corporation Bank.

Types Of Banks In India Introduction And History Of Banking System

Banking In India Types Of Banks Banking Classification Paisabazaar

0 Comments