Initially fast reading without taking notes and underlines should be done. The Impact of the Greek Debt Crisis on the Foreign Direct.

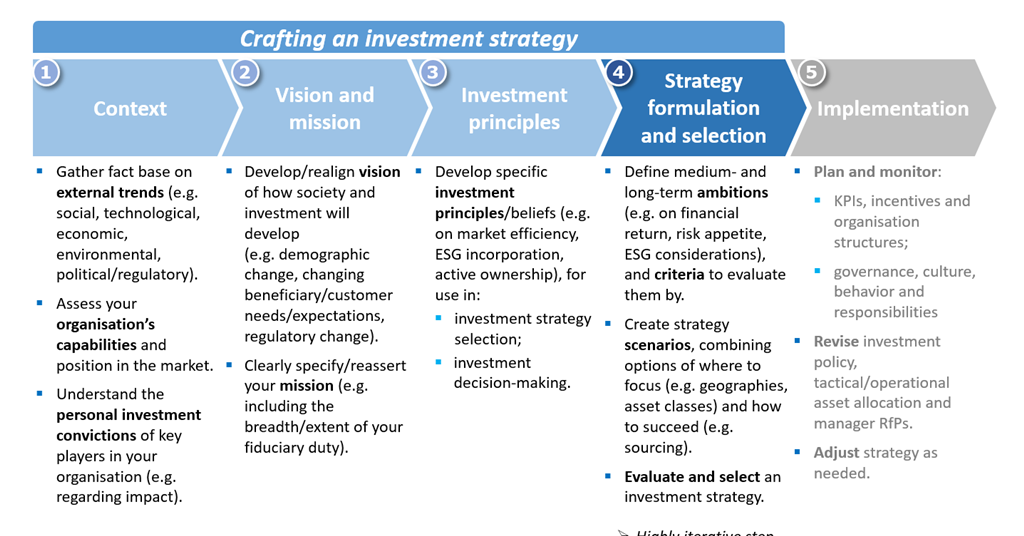

Asset Owner Strategy Guide How To Craft An Investment Strategy Technical Guide Pri

Phases Or Process of Capital Budgeting- Capital Budgeting is a complex process which may be divided into six broad phases- S i Planning ii Analysis iii Selection iv Financing R v Implementation vi Review Phases of Capital Budgeting Process.

. Beyond the short-term impact of an economic downturn on construction demand the crisis is also expected to hit long-term supply and demand resulting in lasting shifts in investment patterns. Concessionary impact investmentswhich seek to preserve capital but may sacrifice some financial return objectives to achieve impactare a small part of our work and are implemented solely at a clients request as they are not appropriate for most investors. Although a high level of economic uncertainty persists research from the McKinsey Global Institute suggests that economic activity could be back on track by early.

Business writer John Elkington claims to have coined the phrase in 1994. TE Planning PU Analysis M O Selection C Financing D ZA Implementation Review 1. Growth equity firms can theoretically invest in any industry of their choosing but the allocation of capital tends to be skewed towards mostly software and industries such as consumer.

At GSAM we focus on ESG and impact investing. Planning- The planning process of a. Implementation Considerations for FMPs and FAs.

Superannuation tools calculator. We have encrypted all our databases. To have a complete understanding of the case one should focus on case reading.

Issues and Policy Considerations May 19 2021 Congressional Research Service httpscrsreportscongressgov R46795. You can manage your investments and view your account balance 24 hours a day 7 days a week. Corporate finance for the pre-industrial world began to emerge in the Italian city-states and the low countries of Europe from the 15th century.

The Impact of Working Capital and Production Costs on Consumer Behavior and Sales Turnover at LQ45 Manufacturing Companies in 2015-2020. Additionally mature companies as targeted by private equity LBO firms may be subject to increased market disruption risks and external competition ie targeted by new entrants. The following are some of the ways we employ to ensure customer confidentiality.

The Vulnerability of a Small Open Economy in A Situation of Global Fiscal Crisis. Whether the misstatement masks a change in earnings. Initial reading is to get a rough idea of what information is.

The triple bottom line or otherwise noted as TBL or 3BL is an accounting framework with three parts. The VOC was also the first recorded joint-stock company to get a fixed capital stock. Many people think of their super as an investment that takes care of itself but the.

We have also been using secure connections EV SSL Our sample essays. The Dutch East India Company also known by the abbreviation VOC in Dutch was the first publicly listed company ever to pay regular dividends. Use our superannuation calculators and tools to find out your super balance might be at retirement and plan how to grow your super balance.

It is said that hbr case study should be read two times. We have servers that operate 999 of the time. Some organizations have adopted the TBL framework to evaluate their performance in a broader perspective to create greater business value.

Statement Of Problem Harvard Case Study Solution and Analysis of READING THE HARVARD CASE STUDY. Managers Lived Experience in Cyberloafing within Business Organizations. All our clients personal information is stored safely.

For FMPs and FAs that operate in the EU to be able to market investments as Article 8 or 9 they will need to review the whole lifecycle of their products from initial product development marketing contracting through to monitoring and reporting and update their policies and processes. Retirement accounts such as deductible IRAs and 401k plans defer taxes on capital gains interest or dividends from investments until the money is withdrawn when it is taxed as ordinary income. Background Selected Issues and Policy Considerations The field of artificial intelligence AIa term first used in the 1950shas gone through multiple waves of.

For some clients grant substitutions andor philanthropy are an. Among the considerations that may well render material a quantitatively small misstatement of a financial statement item are whether the misstatement arises from an item capable of precise measurement or whether it arises from an estimate and if so the degree of imprecision inherent in the estimate 14. In addition to market conditions and the demand drivers listed above below is a list of considerations that go into the calculus for evaluating the financial prospects of an income-producing parking facility.

Social environmental or ecological and financial. Congressional Research Service SUMMARY Artificial Intelligence. If investments are sold after a year they will be charged the capital gains tax which is less than the ordinary income tax.

Impending capital needs such as restriping structural upgrades and more can have a negative impact on pricing.

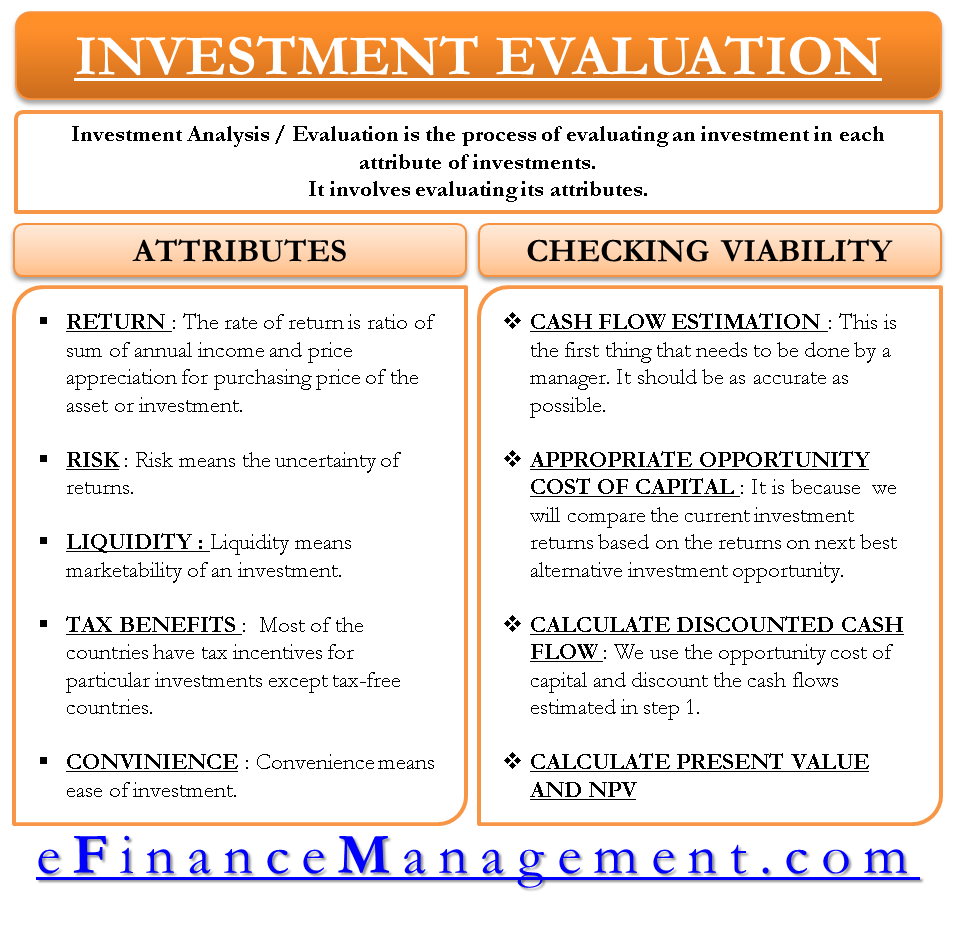

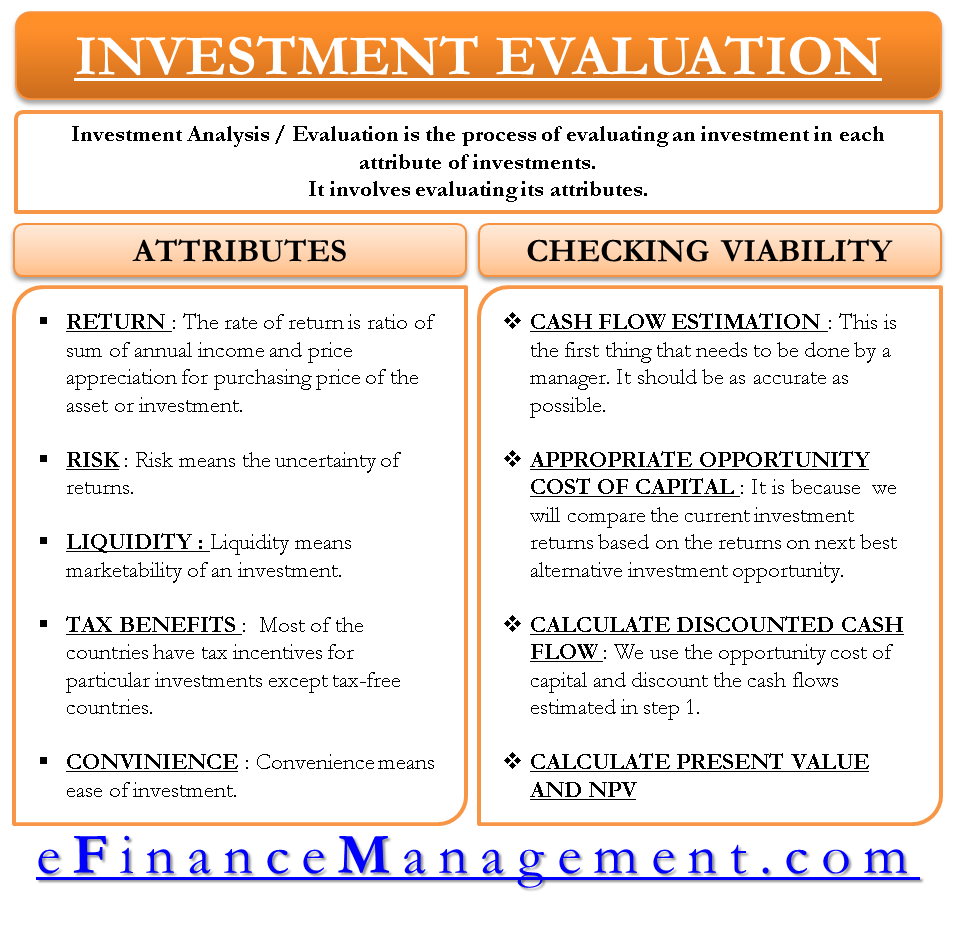

Investment Analysis Evaluation And Attributes Efm

/analysis-1841158_19201-9f449ee62ea54690b015f2d8a705208a.jpg)

0 Comments